The following information was extracted from the books of Daudu Manufacturing company for the year ended 31st December 2012. Stock of goods 1st January 2012...

Question 1 Report

The following information was extracted from the books of Daudu Manufacturing company for the year ended 31st December 2012.

Stock of goods 1st January 2012:

Raw materials------------------8,000

Finished goods-----------------28,000

Work-in-progress ---------------2,000

Purchases of raw materials---40,000

Carriage inwards------------------1,000

Manufacturing wages-----------100,000

Sales------------------------------- 390,000

Rent-------------------------------- 50,000

Factory expenses-------------- 60,000

Royalties------------------------- 1500

Stock of goods - 31st December 2012

Raw materials-----------------------6,000

Finished goods---------------------26,000

Work-in-progress------------------1,5000

Depreciation:

Machinery----------------------------7,500

Delivery van------------------------- 1,280

Selling expenses ------------------ 3,000

Discount allowed------------------- 1,500

Additional information:

i. Factory expenses prepaid amounted to D5,000

ii. Selling expenses accrued was D2,500

iii. Rent is apportioned between factory and selling department in the ratio 5:3 respectively.

You are required to prepare Manufacturing, Trading, and Profit and Loss Account for the year ended 31st December 2012.

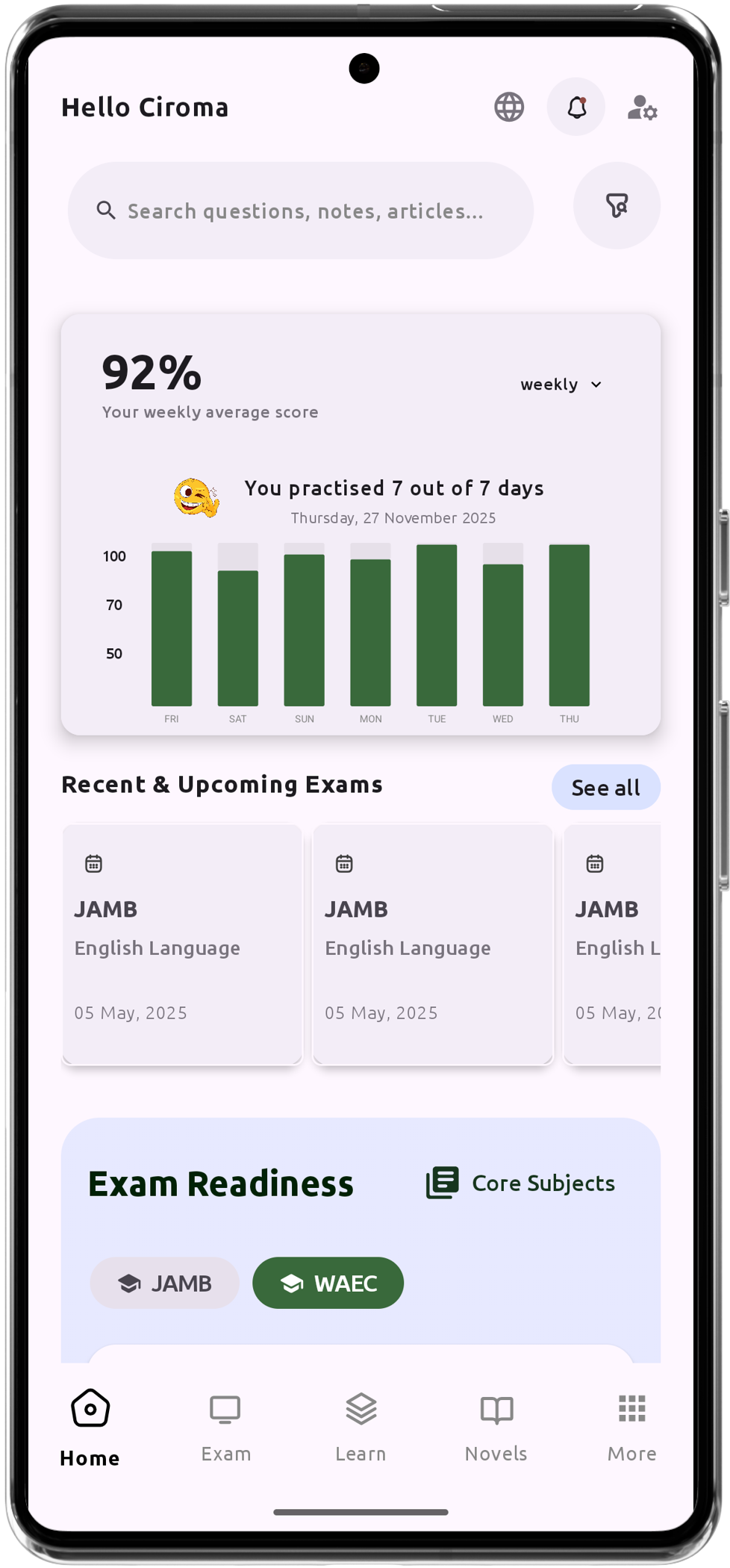

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO