The following information relates to the books of accounts of Adom Ltd. Trading, profit, and loss account for the year ended 31st December 2014 opening stoc...

Question 1 Report

The following information relates to the books of accounts of Adom Ltd.

Trading, profit, and loss account for the year ended 31st December 2014

| opening stock 20,000 purchase 160,000 180,000 less closing stock 36,000 cost of goods sold 144,000 Gross profit c/d 96,000 240,000 selling & distri. exp 73,200 administrative exp 14,800 Net profit 8,000 96,000 |

sales 240,000 240,000 Gross profit b/d 96,000 96,000 |

Balance sheet as at 31st December 2014

| Share capital: Ordinary shares 100,000 Preference shares 10,000 General reserve 24,000 Profit & loss acc 8,000 32,000 142,000 Current liabilities Trade creditors 28,000 Accruals 12,000 40,000 182,000 |

Fixed assets at cost 125,000 Less depreciation 25,000 100000 Current assets: Stock 36,000 Debtors 39,000 Cash in bank 7,000 82,000 182,000 |

You are required to calculate any six of the following

(a) Gross profit percentage

(b) Net profit percentage

(c) Return on capital employed

(d) Current ratio

(e) Acid test ratio

(f) Rate of stock of turnover

(g) Working capital

(h) Shareholders fund

(i) Liquid assets

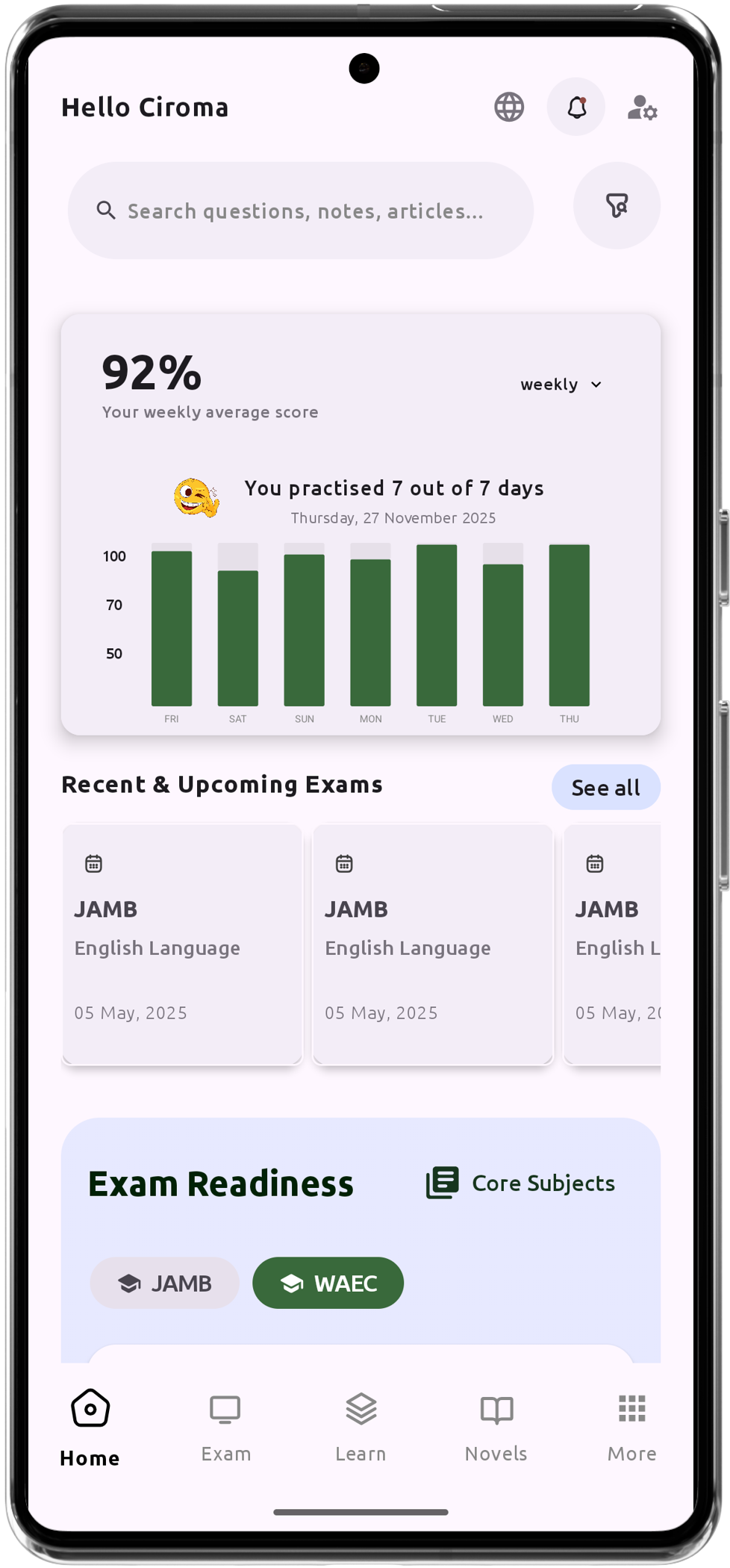

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO

Personalized AI Learning Chat Assistant

Thousands of JAMB, WAEC & NECO Past Questions

Over 1200 Lesson Notes

Offline Support - Learn Anytime, Anywhere

Green Bridge Timetable

Literature Summaries & Potential Questions

Track Your Performance & Progress

In-depth Explanations for Comprehensive Learning