Use the following information to answer the given question Emeka Chukwudi (Nig.) Limited is a manufacturing company. Its books showed the following for the ...

Question 1 Report

Use the following information to answer the given question

Emeka Chukwudi (Nig.) Limited is a manufacturing company. Its books showed the following for the year ended 31st December, 1990

\(\begin{array}{c|c} \text{Opening stock - Raw materials} & 42,000 \\ \text{Purchases - Raw materials} & 265,000 \\ \text{Outwards} & 13,000 \\ \text{Returns outwards} & 13,000 \\ \text{Depreciation - plant and Machinery} & 10,000 \\ wages & 52,000 \\ \text{Closing stock - Raw materials} & 72,000 \\ \text{Direct expenses} & 11,000 \\ \text{Production Manager's salaries} & 18,000 \\ \text{Factory rent} & 15,000\end{array}\)

The cost of production is

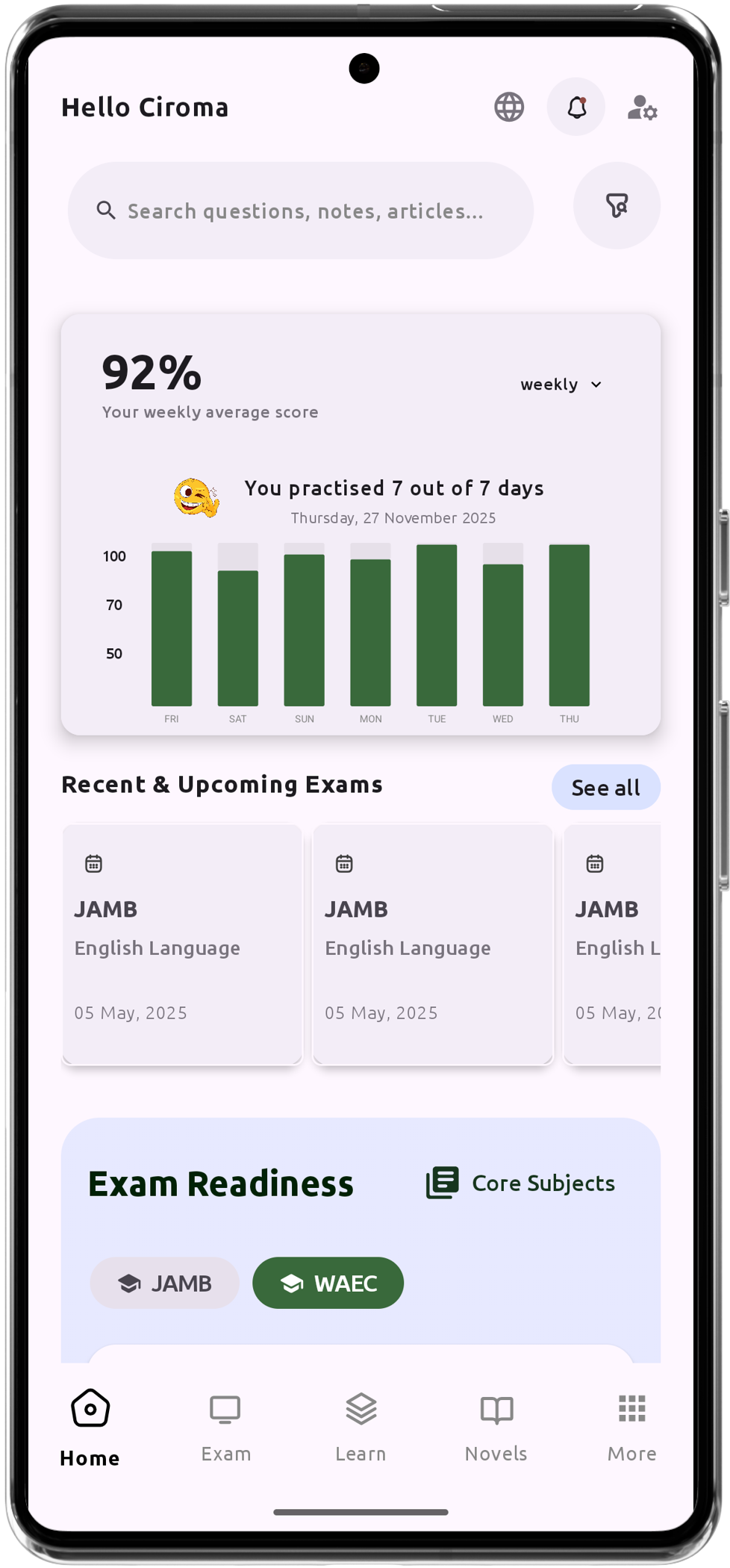

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO