The table below shows the tax payments of four income earners in a year. Use the information in the table to answer the questions that follow. Income Earner...

Question 1 Report

The table below shows the tax payments of four income earners in a year. Use the information in the table to answer the questions that follow.

| Income Earners |

Income Base |

tax | Payments |

| N | N | ||

| A | B | ||

| Jawara | 15,000.00 | 1,500.00 | 1,200.00 |

| Ade | 25,000.00 | 2,000.00 | 2,000.00 |

| Eke | 32,000.00 | 3,200.00 | 2,240.00 |

| Audu | 60,000.00 | 6,000.00 | 3,000.00 |

(a) Determine the percentage rate of taxation paid by

(i) Jawara in columns A and B.

(ii) Audu in columns A and B.

(iii) Ade in columns B.

(iv) Eke in column B

(b)(i) Identify the systems of taxation employed in columns A and B.

(ii) Which of the income earners have the least burden under column B?

(c) (i) If government increases its rate of taxation to 15% flat rate, how much revenue will be generated from the payees?

(ii) At 15% flat rate taxation, calculate the disposable incomes of Messrs Jawara, Ade, Eke and Audu.

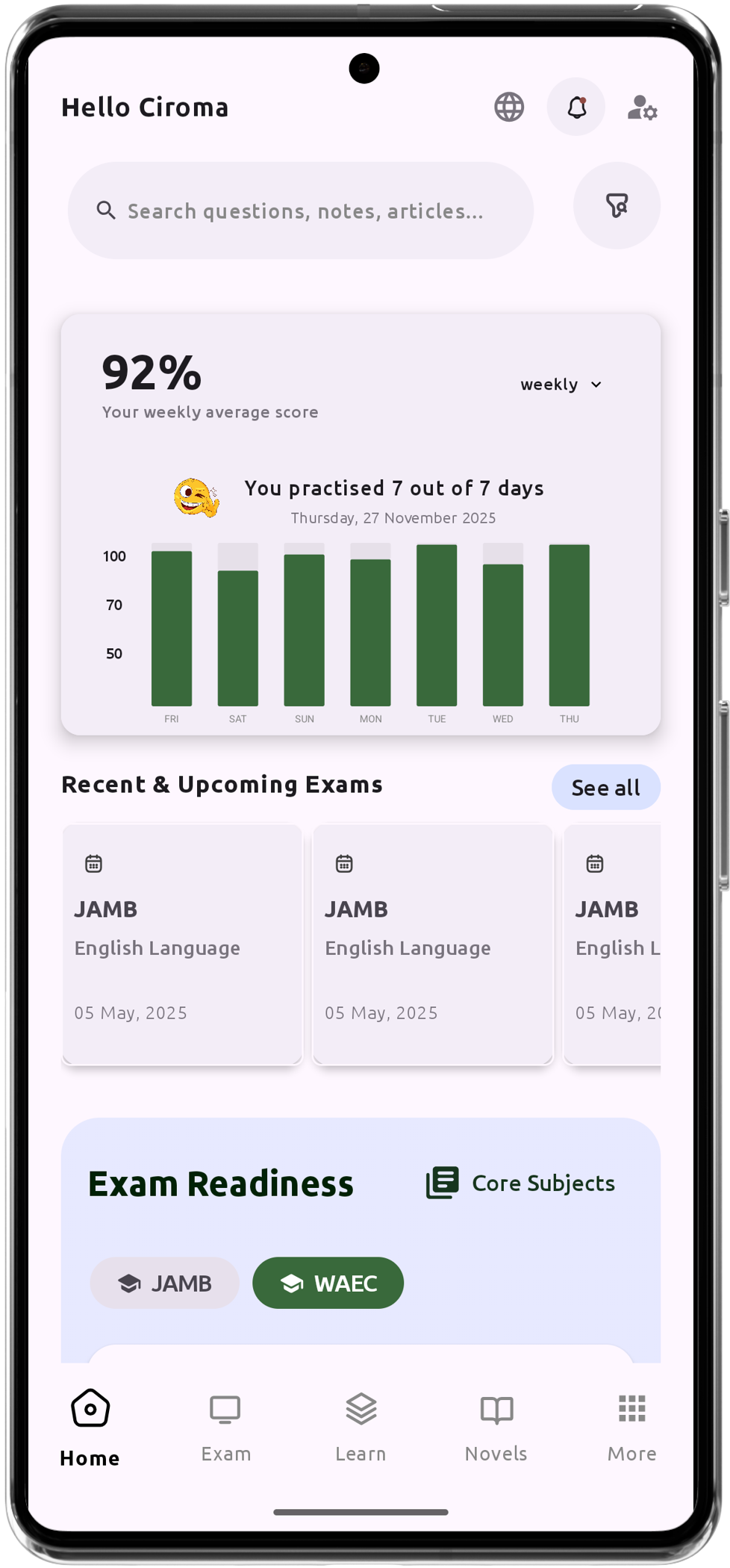

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO