Use the information below to answer question 38 and 39.Dan and Baker are in partnership with capital of ₦50,000 and ₦30,000 each. The partnership agreement ...

Question 1 Report

Use the information below to answer question 38 and 39.Dan and Baker are in partnership with capital of ₦50,000 and ₦30,000 each. The partnership agreement provides that:(i) profits be shared in the ratio of capital. (ii) Baker be paid a salary of ₦8,000.

(iii) both partners earn interest on capital at 6% p.a.

(iv) both partners pay interest on drawing at 6% p.a.

At the end of the year, Dan drew ₦15,000 while Baker drew ₦14,000 in four installment on 31/3,30/6,30/9 and 31/12. The net profit for the year was ₦48,000. ₦5,000 is to be written off the Goodwill account.What is the interest on the drawing by Baker?

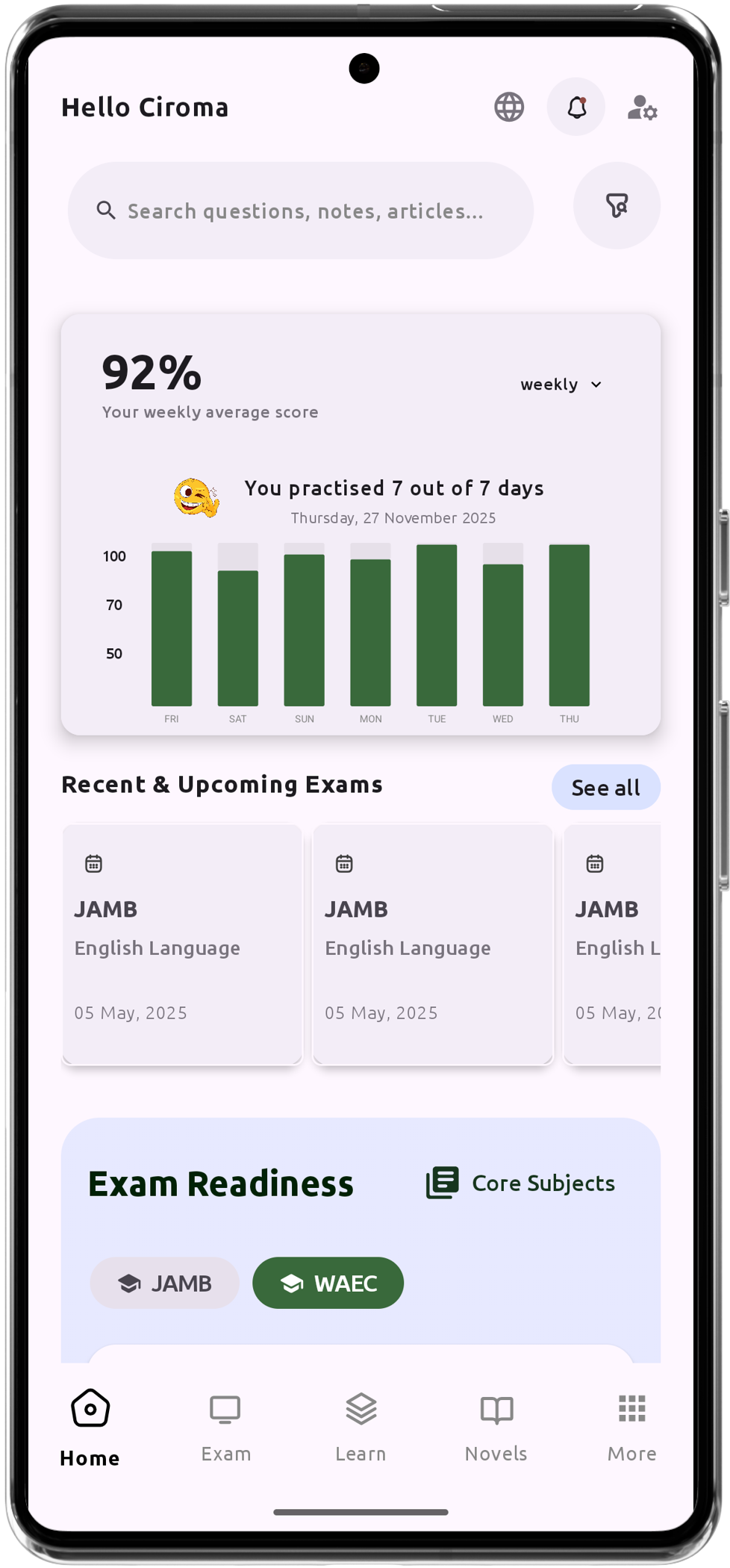

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO