Use the following information to answer the questions below A manufacturing company's cost of production was D 200,000. The finished goods were transferred ...

Question 1 Report

Use the following information to answer the questions below

A manufacturing company's cost of production was D 200,000. The finished goods were transferred to the warehouse at D 220,000. At the end of the year, 9% of these goods were still in stock.

The value of the closing stock of finished goods that would be shown in the balance sheet is

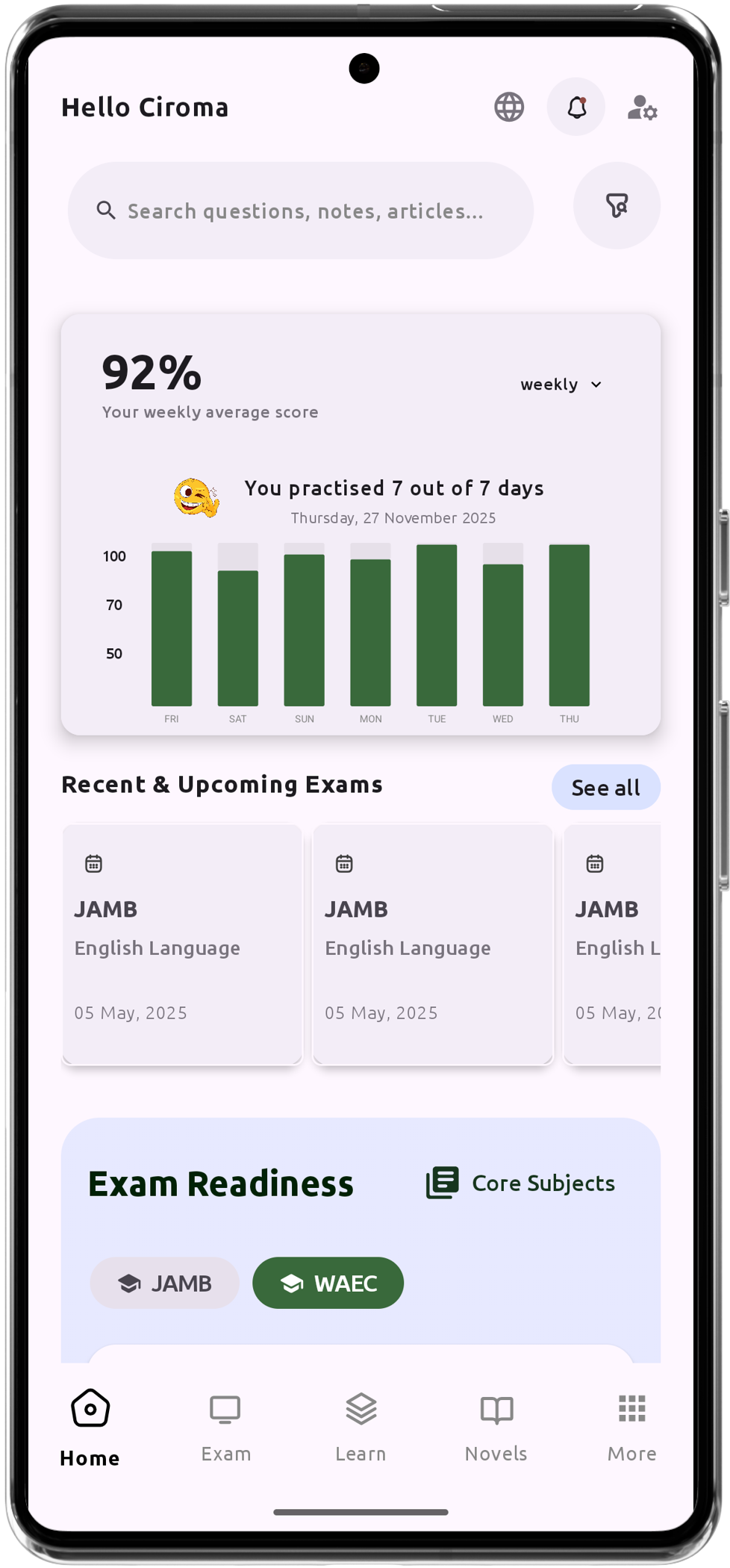

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO

Personalized AI Learning Chat Assistant

Thousands of JAMB, WAEC & NECO Past Questions

Over 1200 Lesson Notes

Offline Support - Learn Anytime, Anywhere

Green Bridge Timetable

Literature Summaries & Potential Questions

Track Your Performance & Progress

In-depth Explanations for Comprehensive Learning