Which of the following concept stipulates that accounting profit is the difference between revenue and expenses?

Question 1 Report

Which of the following concept stipulates that accounting profit is the difference between revenue and expenses?

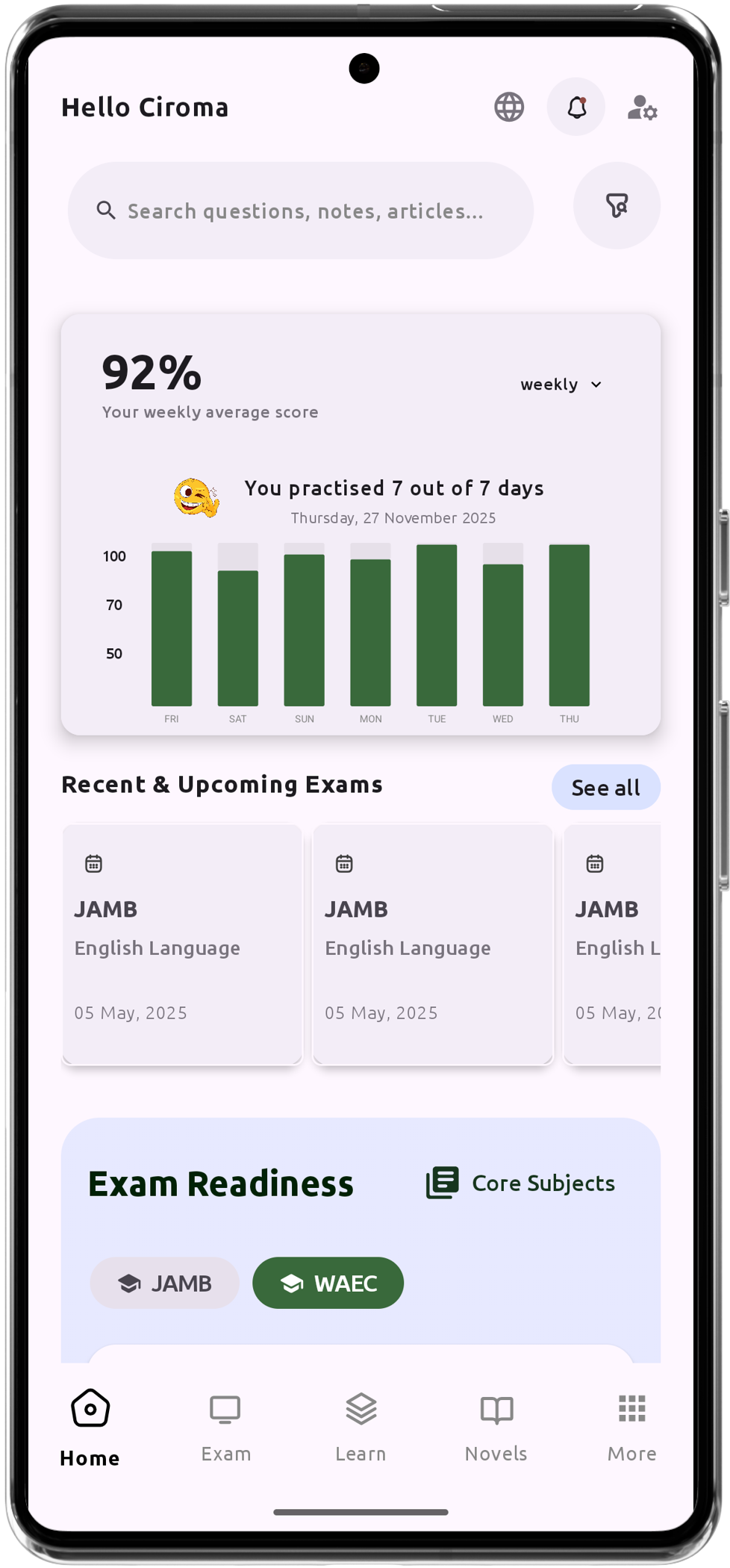

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO

Personalized AI Learning Chat Assistant

Thousands of JAMB, WAEC & NECO Past Questions

Over 1200 Lesson Notes

Offline Support - Learn Anytime, Anywhere

Green Bridge Timetable

Literature Summaries & Potential Questions

Track Your Performance & Progress

In-depth Explanations for Comprehensive Learning