a. The authorized and issued share capital of Ozideli Limited comprised 400,000 ordinary shares of Le 1 each and 100,000 8% preference shares of Le 1 each. ...

Question 1 Report

a. The authorized and issued share capital of Ozideli Limited comprised 400,000 ordinary shares of Le 1 each and 100,000 8% preference shares of Le 1 each. The trial balance at the end of the year was as follows:

Trial Balance as at 31st December 2018

| Dr | Cr | |

| Le | Le | |

| Sales | 1,500,000 | |

| Purchases | 1,000,000 | |

| General expenses | 280,000 | |

| Debenture interest | 8,400 | |

| 7% Debentures | 120,000 | |

| Ordinary share capital | 400,000 | |

| 8% Peference share capital | 100,000 | |

| Plant and machinery at cost | 160,000 | |

| Motor vehicle at cost | 70,000 | |

| Profit and loss account (31/12/17) | 8,600 | |

| Creditors | 172,400 | |

| Debtors | 500,000 | |

| General reserve | 10,000 | |

| Provision for depreciation: | ||

| Plant and Machinery; | 20,000 | |

| Motor vehicle | 10,000 | |

| Bank | 22,600 | |

| Stock (31/12/17) | 300,000 | |

| 2,341,000 | 2,341,000 |

Additional information:

(i) Stock on hand at 31/12/2018 was Le 400,000;

(ii) The directors were to receive remuneration of Le 70,000;

(iii) Depreciation is to be calculated on plant and machinery at Le 32,000 and motor vehicle at Le 14,000;

(iv) The directors decided to transfer Le 12,000 to general reserve;

(v) Preference dividend for 2018 will be paid on 10/01/2019.

You are required to prepare:

Trading, Profit and Loss and Appropriation Account for the year ended 31st December 2018;

b. The authorized and issued share capital of Ozideli Limited comprised 400,000 ordinary shares of Le 1 each and 100,000 8% preference shares of Le 1 each. The trial balance at the end of the year was as follows:

Trial Balance as at 31st December 2018

| Dr | Cr | |

| Le | Le | |

| Sales | 1,500,000 | |

| Purchases | 1,000,000 | |

| General expenses | 280,000 | |

| Debenture interest | 8,400 | |

| 7% Debentures | 120,000 | |

| Ordinary share capital | 400,000 | |

| 8% Peference share capital | 100,000 | |

| Plant and machinery at cost | 160,000 | |

| Motor vehicle at cost | 70,000 | |

| Profit and loss account (31/12/17) | 8,600 | |

| Creditors | 172,400 | |

| Debtors | 500,000 | |

| General reserve | 10,000 | |

| Provision for depreciation: | ||

| Plant and Machinery; | 20,000 | |

| Motor vehicle | 10,000 | |

| Bank | 22,600 | |

| Stock (31/12/17) | 300,000 | |

| 2,341,000 | 2,341,000 |

Additional information:

(i) Stock on hand at 31/12/2018 was Le 400,000;

(ii) The directors were to receive remuneration of Le 70,000;

(iii) Depreciation is to be calculated on plant and machinery at Le 32,000 and motor vehicle at Le 14,000;

(iv) The directors decided to transfer Le 12,000 to general reserve;

(v) Preference dividend for 2018 will be paid on 10/01/2019.

You are required to prepare:

Balance sheet as at that date

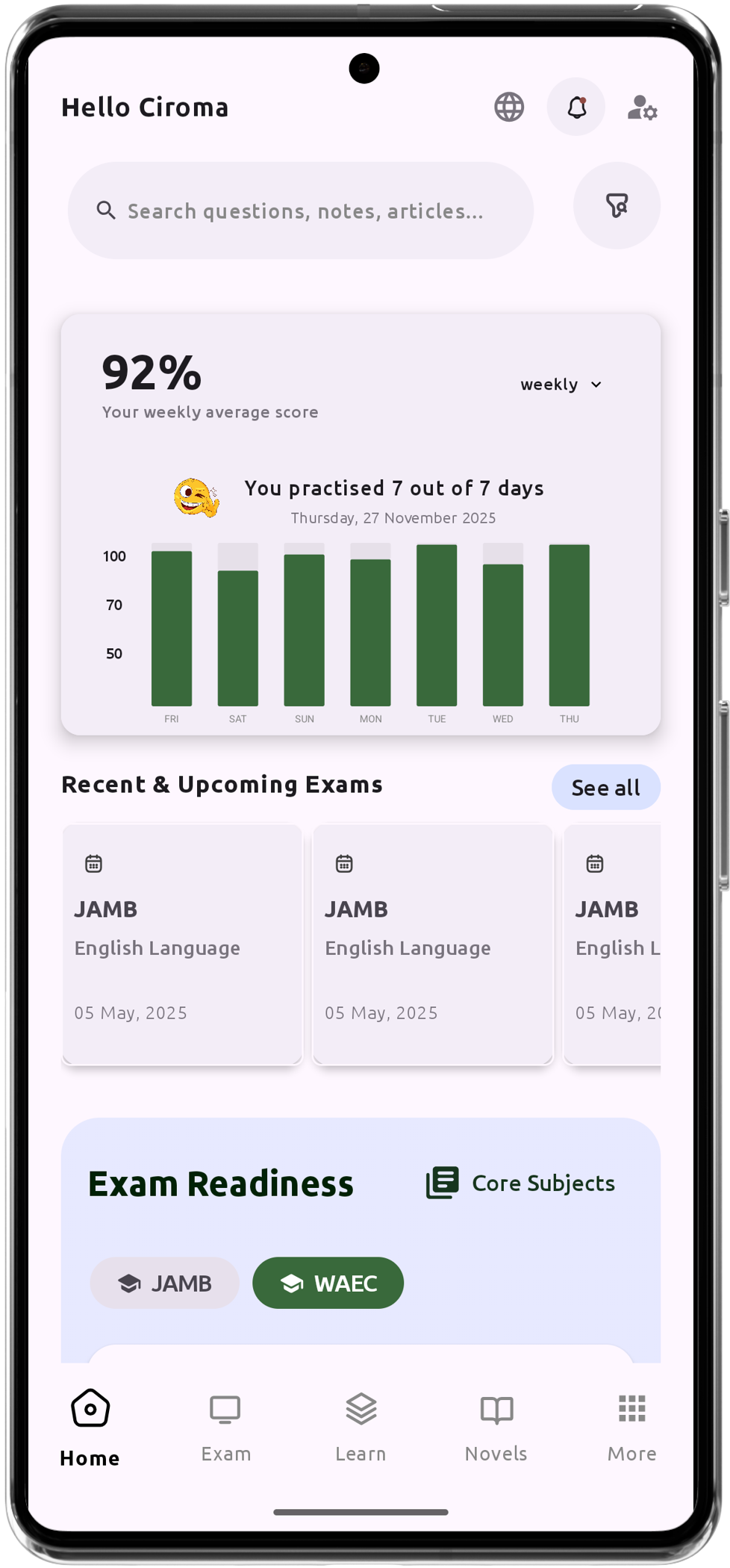

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO