a. The cash book of Dupe Enterprises showed an overdrawn balance of #216,126 and her bank statement also showed #905,625 overdrawn. On 31/12/2016, a detaile...

Question 1 Report

a. The cash book of Dupe Enterprises showed an overdrawn balance of #216,126 and her bank statement also showed #905,625 overdrawn. On 31/12/2016, a detailed examination of the records showed the following differences:

(i) A cheque drawn for #697,550 had been entered in the cash book as #365,050.

(ii) A standing order of #420,000 and bank charges of #8,750 entered in the bank statement has not been recorded in the cash book.

(iii) Bank lodgment of #1,922,375 on 27th December 2016 has not been credited by the bank.

(iv) Dividend received of #315,000 had been recorded in the bank but not entered in the cash book.

(v) Cheques paid to suppliers totalling #1,165,500 has not been presented for payment.

(vi) A cheque for #700,000 received from Tunde was dishonoured by the banki but no entry had been made in the cash book.

(vii) A cheque of #256,813 received from a customer was entered as a payment in the cash book.

(viii) A cheque for #350,000 recorded in Dupe Enterprises cash book had been credited by the bank to Dudu Enterprises' account.

(ix) An amount of #1,050,000 received from customer was paid directly to Dupe Enterprises account but no entry was made in the cash book.

You are required to prepare:

Dupe Enterprises Adjusted Cash Book

b. The cash book of Dupe Enterprises showed an overdrawn balance of #216,126 and her bank statement also showed #905,625 overdrawn. On 31/12/2016, a detailed examination of the records showed the following differences:

(i) A cheque drawn for #697,550 had been entered in the cash book as #365,050.

(ii) A standing order of #420,000 and bank charges of #8,750 entered in the bank statement has not been recorded in the cash book.

(iii) Bank lodgment of #1,922,375 on 27th December 2016 has not been credited by the bank.

(iv) Dividend received of #315,000 had been recorded in the bank but not entered in the cash book.

(v) Cheques paid to suppliers totalling #1,165,500 has not been presented for payment.

(vi) A cheque for #700,000 received from Tunde was dishonoured by the banki but no entry had been made in the cash book.

(vii) A cheque of #256,813 received from a customer was entered as a payment in the cash book.

(viii) A cheque for #350,000 recorded in Dupe Enterprises cash book had been credited by the bank to Dudu Enterprises' account.

(ix) An amount of #1,050,000 received from customer was paid directly to Dupe Enterprises account but no entry was made in the cash book.

You are required to prepare:

Bank Reconciliation Statement as at 31st December 2016

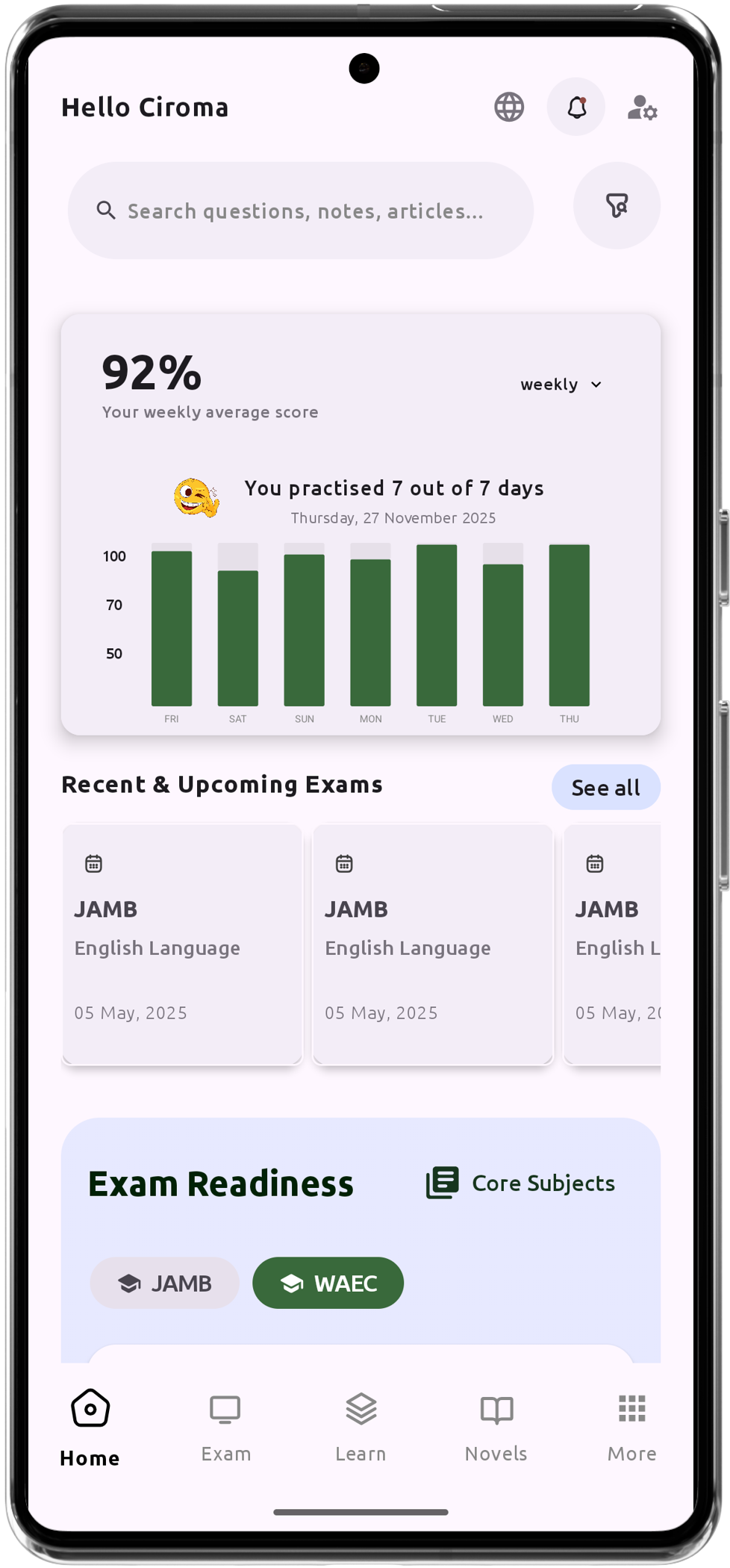

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO