The tables below show the expected revenues and projected expenditures from the budget of a hypothetical country in 1998. Use the information in the tables ...

Question 1 Report

The tables below show the expected revenues and projected expenditures from the budget of a hypothetical country in 1998. Use the information in the tables to answer the questions that follow.

EXPECTED REVENUE

| ITEM | AMOUNT ($ millions) |

| Rents, royalties and profits | 75.00 |

| Company income tax | 150.00 |

| Customs and excise duties | 300.20 |

| Personal income tax | 80.00 |

| Fees specific charges | 60.80 |

| Value added tax | 100.00 |

PROJECTED EXPENDITURE

| ITEM | AMOUNT ($ millions) |

| General administration | 220.10 |

| Maintenance of foreign missions | 50.00 |

| Transfer payments | 65.00 |

| Building of schools and hospitals | 200.00 |

| Road construction | 180.90 |

(a) Calculate the total revenue from

(i) direct taxes [3 marks]

(ii) indirect taxes [3 marks]

(iii) non-tax sources [3 marks]

(b) Determine the total

(i) capital expenditure [3 marks]

(ii) recurrent expenditure [3 marks]

(c) Determine whether the budget is a surplus or deficit. [5 marks]

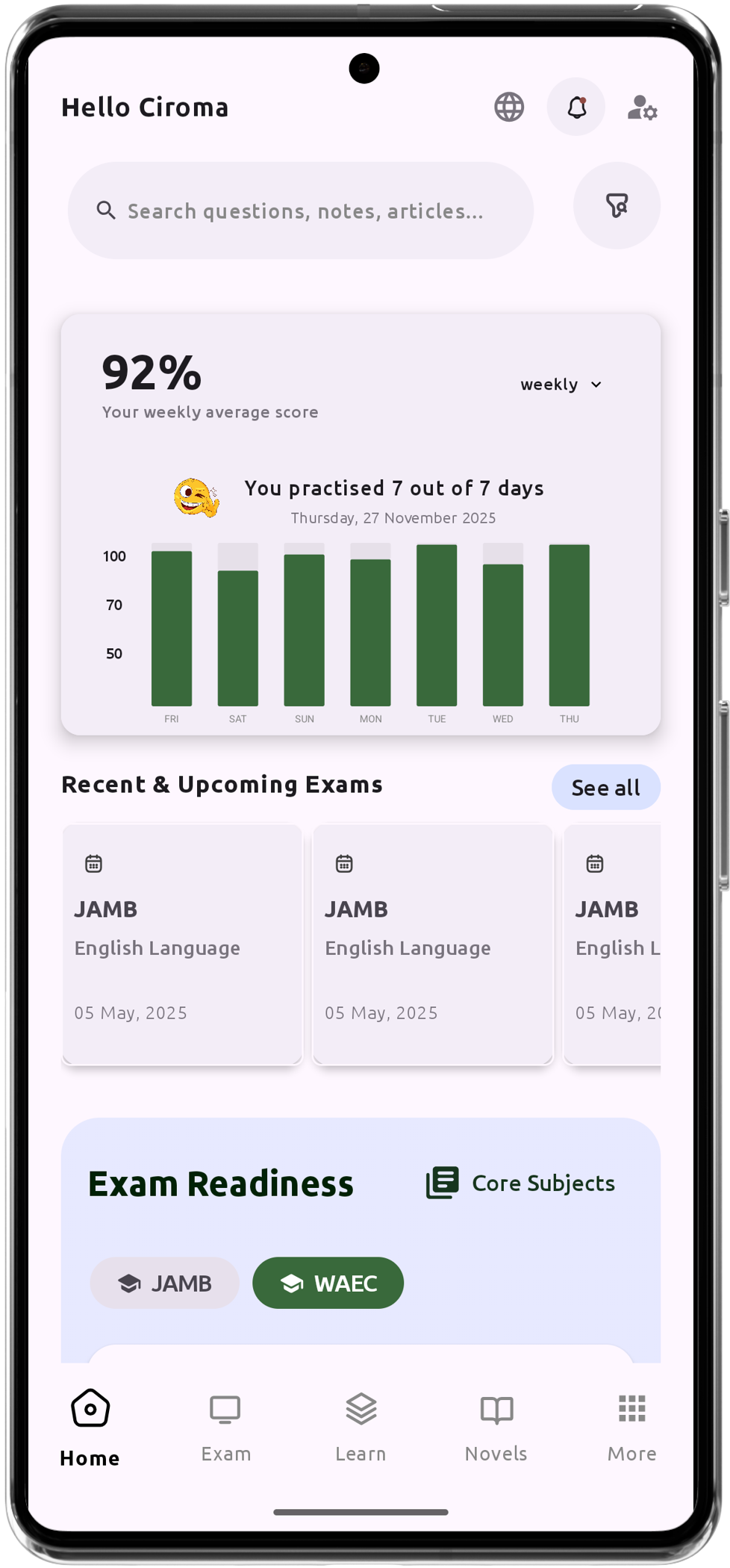

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO

Personalized AI Learning Chat Assistant

Thousands of JAMB, WAEC & NECO Past Questions

Over 1200 Lesson Notes

Offline Support - Learn Anytime, Anywhere

Green Bridge Timetable

Literature Summaries & Potential Questions

Track Your Performance & Progress

In-depth Explanations for Comprehensive Learning