If the prices of a commodity increases from N8.00 to N10.00 and the demand decreases from 100 to 80 respectively, wha is the price elasticity of demand for ...

Question 1 Report

If the prices of a commodity increases from N8.00 to N10.00 and the demand decreases from 100 to 80 respectively, wha is the price elasticity of demand for the commodity?

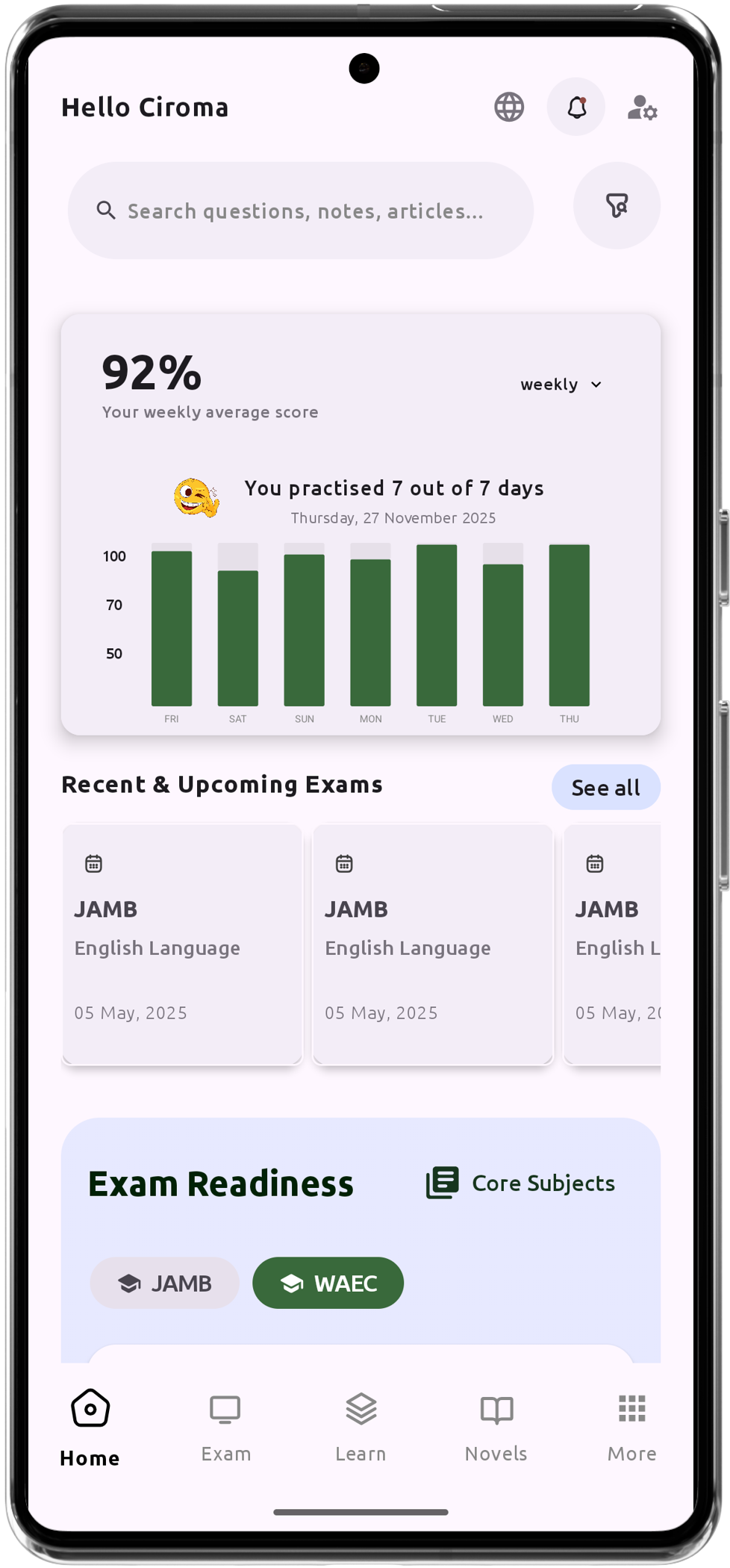

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO

Personalized AI Learning Chat Assistant

Thousands of JAMB, WAEC & NECO Past Questions

Over 1200 Lesson Notes

Offline Support - Learn Anytime, Anywhere

Green Bridge Timetable

Literature Summaries & Potential Questions

Track Your Performance & Progress

In-depth Explanations for Comprehensive Learning