Baako Ltd purchased motor vehicle as follows: Date Quantity N 01/01/13 1 800,000 01/07/13 1 400,000 01/04/15 1 600,000 The company adopts a straight-line me...

Question 1 Report

Baako Ltd purchased motor vehicle as follows:

Date Quantity N

01/01/13 1 800,000

01/07/13 1 400,000

01/04/15 1 600,000

The company adopts a straight-line method of depreciation at the rate of 10% per annum from the date of purchase. A separate account is prepared for provision for depreciation. On 30h June 2014, the motor vehicle which was purchased on 1st July 2013 was sold for N6 240,000

You are required to prepare:

(a) Motor Vehicle Account for the year, 2013, 2014, and 2015.

(b) Provision for Depreciation on Motor Vehicle Account for the years 2013, 2014, and 2015.

(c) Motor Vehicle Disposal Account.

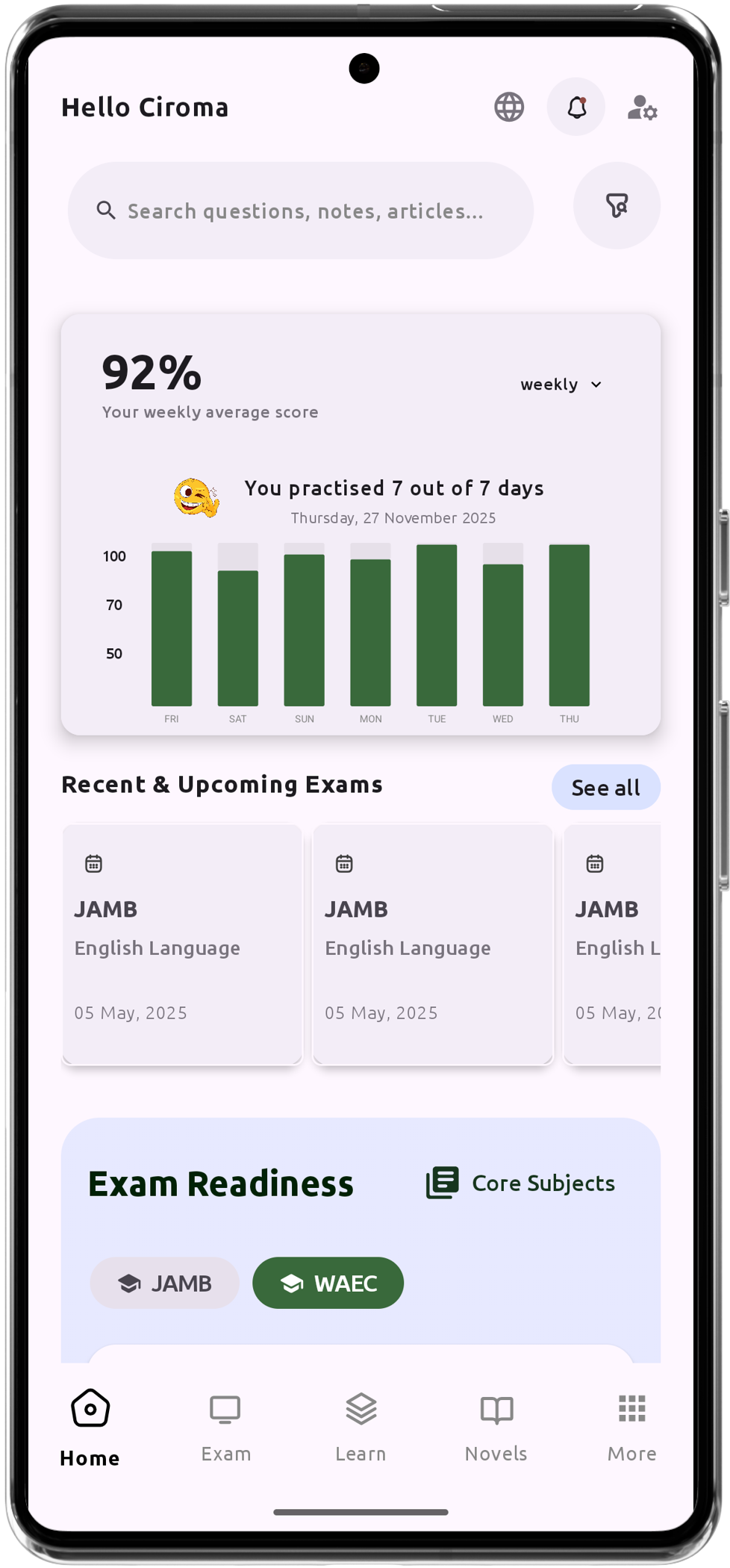

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO