On 31 December 2016, the bank column of the cash book of Aminata Enterprise showed a debit balance of D48,500. However, the bank statement showed a credit b...

Question 1 Report

On 31 December 2016, the bank column of the cash book of Aminata Enterprise showed a debit balance of D48,500. However, the bank statement showed a credit balance of D54,900 on the same date. A detailed comparison of entries revealed the following;

i. customer's cheques amounting to D8.450 had not been credited by the bank as at 31/12/2016.

ii. Cheques amounting to D8,850 had not been presented for payment as at 31/12/2016

iii. Bank charges of D1,000 and interest on investments of D2,500 collected by the banker appeared only in the bank statement.

iv. On 30/12/2016, there was a wrong credit of D3,000 in the bank statement.

v. Kesse Enterprise, a customer, had paid into the bank directly a sum of D3,000 on 29th December 2016. This had not been recorded in the cash book.

vi. A cheque for D2,000 received from Jallo Enterprises, a customer, which was deposited had been returned unpaid. This had not been entered in the cash book.

You are required to:

(a) Write up the adjusted cash book.

(b) Prepare a bank reconciliation statement as at 31/12/ 2016.

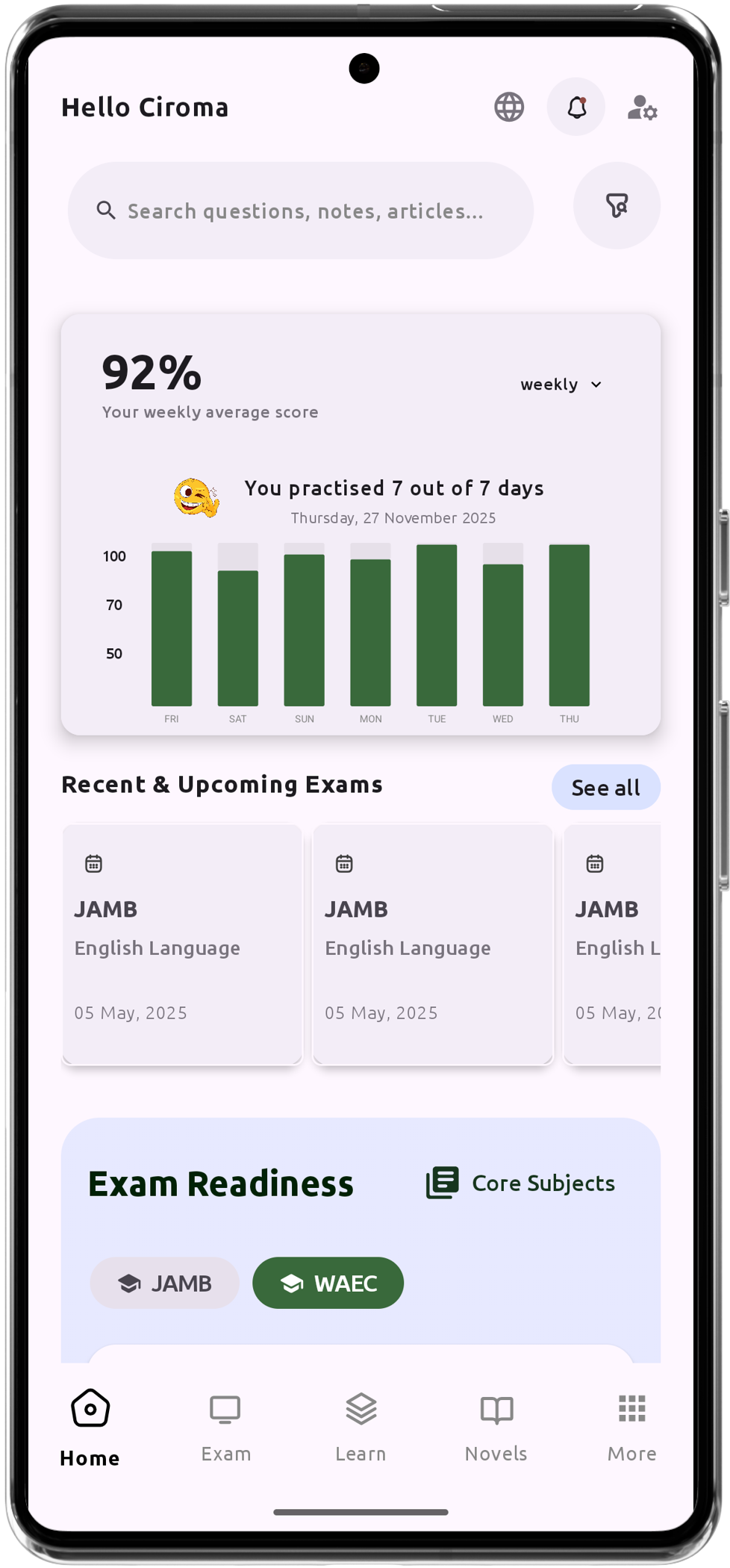

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO