Dauda, a retailer, does not keep proper books of account. The following were balances in his books on January 2013. Premises 70,000 Equipment 8,200 Vehicles...

Question 1 Report

Dauda, a retailer, does not keep proper books of account. The following were balances in his books on January 2013.

Premises 70,000

Equipment 8,200

Vehicles 5,100

Inventory 9,500

Accounts receivable 150

Bank 1400

The summary of his bank statement for the twelve months period from 1st January 2013 to 31st December 2013 is as follows:

Money paid to the bank: 96,500

Shop takings 1,400

Received from debtors 8,000

Payments made by cheque

Inventory purchased 70,500

Delivery Van 6,200

Maintenance of vehicle 1,020

Electricity and water 940

Store boys' wages 5,260

Miscellaneous expenses 962

Additional information;

i. Dauda paid all shop takings for the year into the bank apart from monthly drawings of D500 and miscellaneous expenses of D408.

ii. He was owing, D7, 600 to supplies for inventory bought.

iii. The accounts receivable is to be treated as bad debts.

iv. Inventory was valued at D13,620

v. Depreciation for the year was calculated as D720 for equipment and D1,000 for vehicles.

You are required to prepare:

(a) Statement of Affairs as at 01/01/13

(b) Income Statement for the year ended 31st December 2013

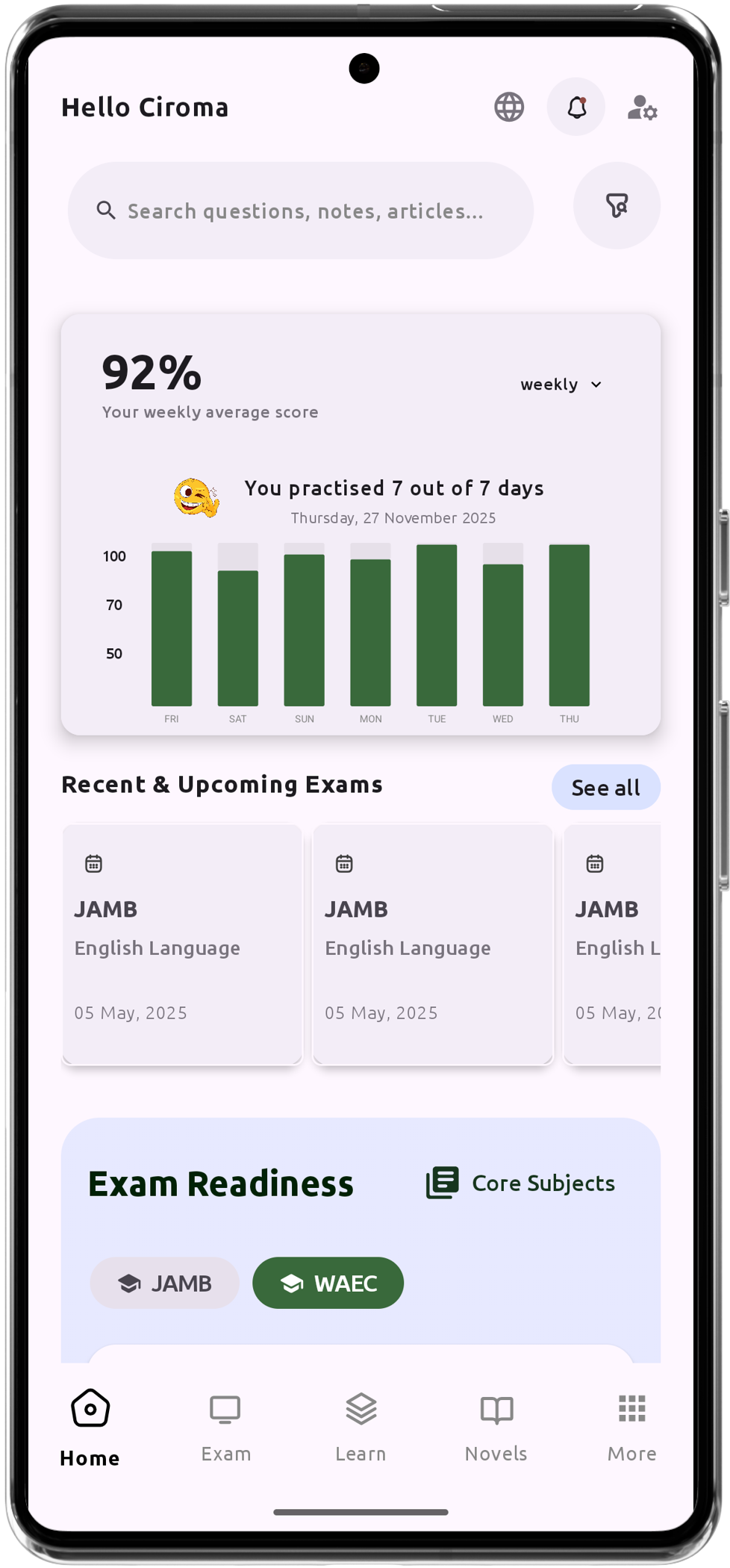

Download The App On Google Playstore

Everything you need to excel in JAMB, WAEC & NECO